SARIMAX Model Analysis of Apple Stock with Exogenous Variables

In the previous articles we saw the limitations of the ARIMA and SARIMA. Therefore, in this article we are going to implement a SARIMAX model the can include exogenous variables

Introduction to Exogenous Variables in Time Series Models

Exogenous variables, also known as external regressors, are independent variables that are not part of the main time series but can influence it. In the context of stock price prediction, exogenous variables might include:

- Market indices (e.g., S&P 500)

- Economic indicators (e.g., GDP growth, unemployment rate)

- Company-specific metrics (e.g., revenue, earnings per share)

- Sentiment indicators (e.g., social media sentiment)

Mathematical Formulation of SARIMAX

The SARIMAX model extends the SARIMA model by including exogenous variables. The mathematical representation is:

$$ φ(B)Φ(Bᵐ)(1-B)ᵈ(1-Bᵐ)D (Yₜ - β₁X₁,ₜ - β₂X₂,ₜ - … - βₖXₖ,ₜ) = θ(B)Θ(Bᵐ)εₜ$$

Where:

- $Yₜ$ is the dependent variable (in our case, Apple stock price)

- $X₁,ₜ, X₂,ₜ, …, Xₖ,$ₜ are the exogenous variables

- $β₁, β₂, …, βₖ$ are the coefficients of the exogenous variables

- All other terms are as defined in the SARIMA model

Implementing SARIMAX for Apple Stock

Let’s implement a SARIMAX model for Apple stock, using the S&P 500 index as an exogenous variable:

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import yfinance as yf

from statsmodels.tsa.statespace.sarimax import SARIMAX

from pmdarima import auto_arima

# Download Apple stock data and S&P 500 data

start_date = "2021-01-01"

end_date = "2024-06-24"

aapl = yf.download("AAPL", start=start_date, end=end_date)['Close']

sp500 = yf.download("^GSPC", start=start_date, end=end_date)['Close']

# Align the data and remove any missing values

data = pd.concat([aapl, sp500], axis=1).dropna()

data.columns = ['AAPL', 'SP500']

# Split the data into train and test sets

train_size = int(len(data) * 0.8)

train, test = data[:train_size], data[train_size:]

test_size = len(test)

# Determine the best SARIMAX model

exog = train['SP500']

endog = train['AAPL']

model = auto_arima(endog, exogenous=exog, seasonal=True, m=12,

start_p=1, start_q=1, start_P=1, start_Q=1,

max_p=3, max_q=3, max_P=2, max_Q=2, d=1, D=1,

trace=True, error_action='ignore', suppress_warnings=True,

stepwise=True, out_of_sample=200)

print(model.summary())

# Fit the SARIMAX model

sarimax_model = SARIMAX(endog, exog=exog, order=model.order, seasonal_order=model.seasonal_order)

results = sarimax_model.fit()

print(results.summary())

Performing stepwise search to minimize aic

ARIMA(1,1,1)(1,1,1)[12] : AIC=inf, Time=1.82 sec

ARIMA(0,1,0)(0,1,0)[12] : AIC=3802.747, Time=0.04 sec

ARIMA(1,1,0)(1,1,0)[12] : AIC=3597.813, Time=0.15 sec

ARIMA(0,1,1)(0,1,1)[12] : AIC=inf, Time=0.99 sec

ARIMA(1,1,0)(0,1,0)[12] : AIC=3804.105, Time=0.04 sec

ARIMA(1,1,0)(2,1,0)[12] : AIC=3525.586, Time=0.34 sec

ARIMA(1,1,0)(2,1,1)[12] : AIC=inf, Time=2.90 sec

ARIMA(1,1,0)(1,1,1)[12] : AIC=inf, Time=1.09 sec

ARIMA(0,1,0)(2,1,0)[12] : AIC=3523.686, Time=0.26 sec

ARIMA(0,1,0)(1,1,0)[12] : AIC=3596.070, Time=0.08 sec

ARIMA(0,1,0)(2,1,1)[12] : AIC=inf, Time=2.63 sec

ARIMA(0,1,0)(1,1,1)[12] : AIC=inf, Time=0.80 sec

ARIMA(0,1,1)(2,1,0)[12] : AIC=3525.569, Time=0.34 sec

ARIMA(1,1,1)(2,1,0)[12] : AIC=3526.799, Time=0.70 sec

ARIMA(0,1,0)(2,1,0)[12] intercept : AIC=3525.686, Time=0.76 sec

Best model: ARIMA(0,1,0)(2,1,0)[12]

Total fit time: 12.965 seconds

SARIMAX Results

==========================================================================================

Dep. Variable: y No. Observations: 697

Model: SARIMAX(0, 1, 0)x(2, 1, 0, 12) Log Likelihood -1758.843

Date: Sun, 07 Jul 2024 AIC 3523.686

Time: 00:01:08 BIC 3537.270

Sample: 0 HQIC 3528.942

- 697

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.S.L12 -0.6850 0.032 -21.233 0.000 -0.748 -0.622

ar.S.L24 -0.3251 0.036 -9.102 0.000 -0.395 -0.255

sigma2 9.9300 0.420 23.621 0.000 9.106 10.754

===================================================================================

Ljung-Box (L1) (Q): 0.09 Jarque-Bera (JB): 50.28

Prob(Q): 0.76 Prob(JB): 0.00

Heteroskedasticity (H): 1.34 Skew: 0.10

Prob(H) (two-sided): 0.03 Kurtosis: 4.31

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

Plotting

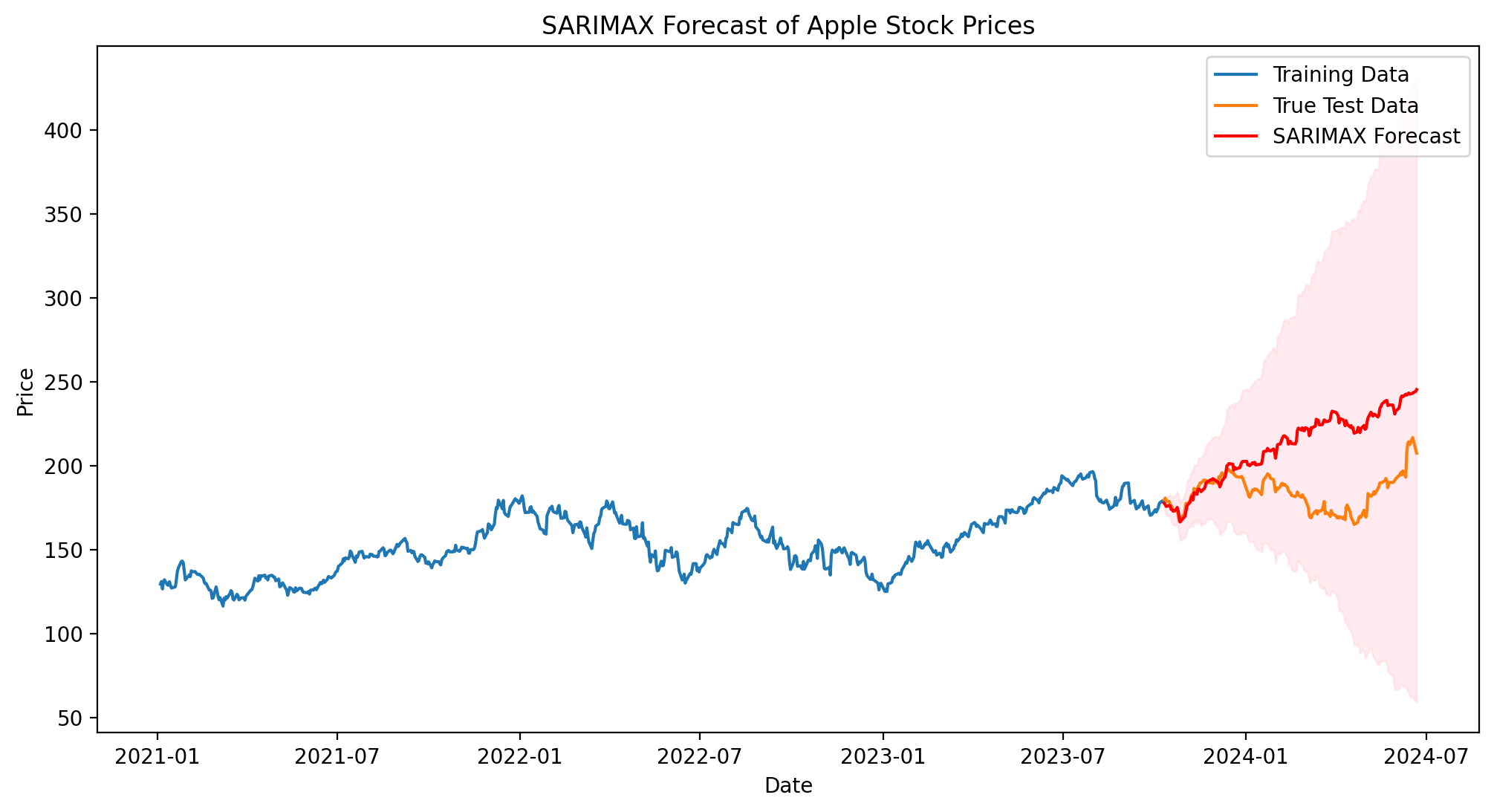

# Forecast

forecast_steps = len(test)

forecast = results.get_forecast(steps=forecast_steps, exog=test['SP500'])

forecast_ci = forecast.conf_int(alpha=0.1)

# Plot the forecast

plt.figure(figsize=(12, 6), dpi=200)

plt.plot(train.index, train['AAPL'], label='Training Data')

plt.plot(test.index, test['AAPL'], label='True Test Data')

plt.plot(test.index, forecast.predicted_mean, color='r', label='SARIMAX Forecast')

plt.fill_between(test.index, forecast_ci.iloc[:, 0], forecast_ci.iloc[:, 1], color='pink', alpha=0.3)

plt.title('SARIMAX Forecast of Apple Stock Prices')

plt.xlabel('Date')

plt.ylabel('Price')

plt.legend()

plt.show()

# Evaluate the model

from sklearn.metrics import mean_squared_error, mean_absolute_error

mse = mean_squared_error(test['AAPL'], forecast.predicted_mean)

mae = mean_absolute_error(test['AAPL'], forecast.predicted_mean)

rmse = np.sqrt(mse)

print(f'Mean Squared Error: {mse:.4f}')

print(f'Mean Absolute Error: {mae:.4f}')

print(f'Root Mean Squared Error: {rmse:.4f}')

# Check the impact of the exogenous variable

print(results.summary())

Mean Squared Error: 1235.4975

Mean Absolute Error: 28.1924

Root Mean Squared Error: 35.1496

SARIMAX Results

==========================================================================================

Dep. Variable: AAPL No. Observations: 697

Model: SARIMAX(0, 1, 0)x(2, 1, 0, 12) Log Likelihood -1385.522

Date: Sun, 07 Jul 2024 AIC 2779.044

Time: 00:01:09 BIC 2797.156

Sample: 0 HQIC 2786.053

- 697

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

SP500 0.0475 0.001 37.409 0.000 0.045 0.050

ar.S.L12 -0.6961 0.027 -25.701 0.000 -0.749 -0.643

ar.S.L24 -0.3266 0.032 -10.212 0.000 -0.389 -0.264

sigma2 3.3320 0.127 26.340 0.000 3.084 3.580

===================================================================================

Ljung-Box (L1) (Q): 1.59 Jarque-Bera (JB): 153.93

Prob(Q): 0.21 Prob(JB): 0.00

Heteroskedasticity (H): 0.98 Skew: -0.02

Prob(H) (two-sided): 0.87 Kurtosis: 5.32

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

This model provide a good forecast for the first 20 candles, then it loses accuracy incrementally after that period (as the confidence levels diverges). A solution could be to retrain the model each month or some other arbitrary period. In the next section, we will see how to perform that in a simple way.

Update Model each month

predictions = []

conf_inters = []

step = 20 # one month has 20 tradable days

for i in range(0, test_size, step):

# Split the data into train and test sets

train_size = int(len(data) * 0.8) + i

train, test = data[:train_size], data[train_size:train_size+step]

# Determine the best SARIMAX model

exog = train['SP500']

endog = train['AAPL']

# Fit the SARIMAX model

sarimax_model = SARIMAX(endog, exog=exog, order=model.order, seasonal_order=model.seasonal_order)

results = sarimax_model.fit()

# Forecast

forecast_steps = len(test)

forecast = results.get_forecast(steps=forecast_steps, exog=test['SP500'])

forecast_ci = forecast.conf_int()

predictions.append(forecast.predicted_mean)

conf_inters.append(forecast_ci)

# print(i, forecast_steps)

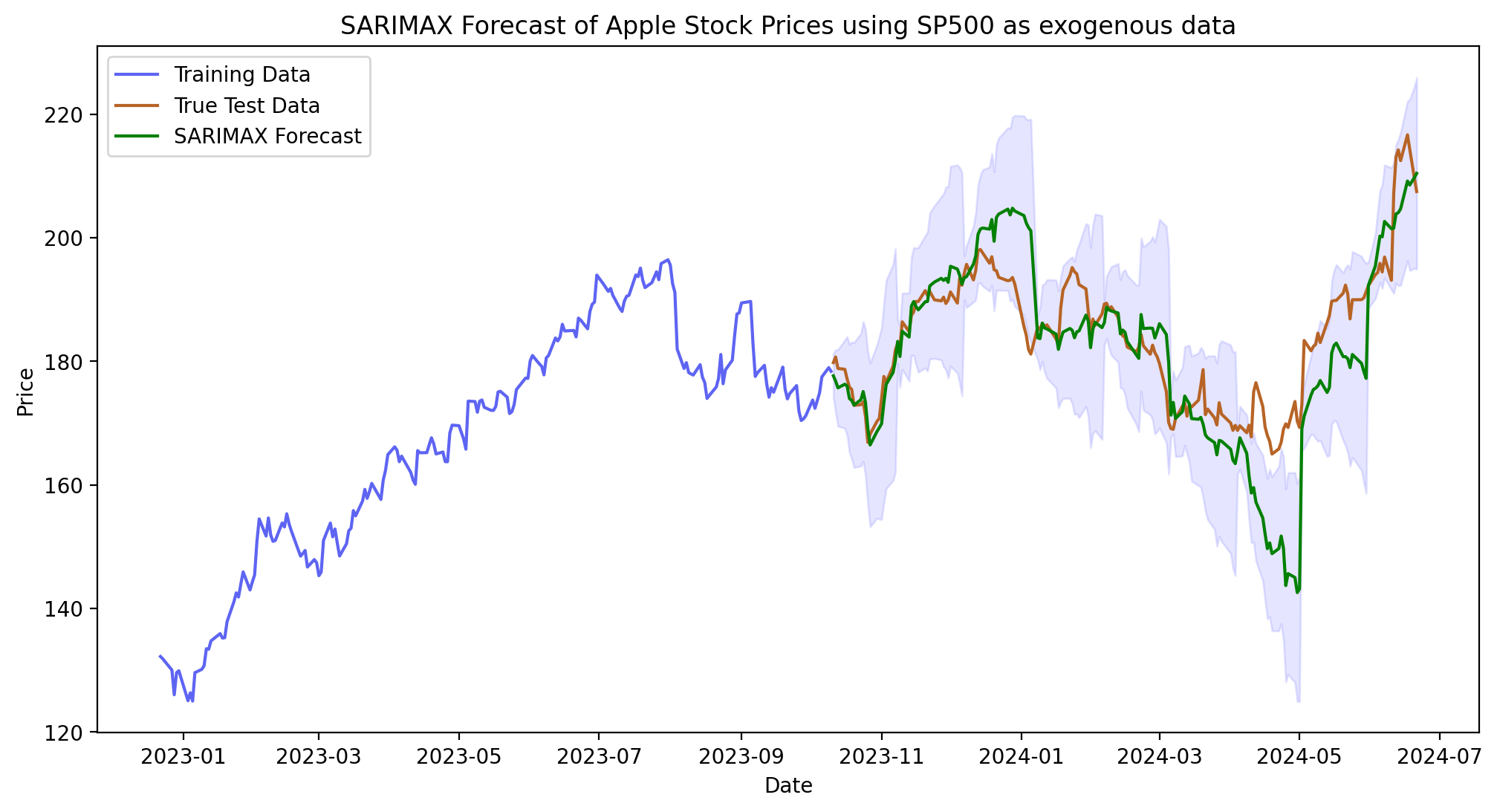

Plotting

# Concatenate predictions list

forecasts = pd.concat(predictions)

forecasts_ci = pd.concat(conf_inters)

# Split the data into train and test sets

train_size = int(len(data) * 0.8)

train, test = data[:train_size], data[train_size:]

test_size = len(test)

# Plot the forecast

plt.figure(figsize=(12, 6), dpi=200)

plt.plot(train.index[-200:], train['AAPL'].iloc[-200:], label='Training Data', color="#5e64f2")

plt.plot(test.index, test['AAPL'], label='True Test Data', color="#b76426")

plt.plot(test.index, forecasts, color='g', label='SARIMAX Forecast')

plt.fill_between(test.index, forecasts_ci.iloc[:, 0], forecasts_ci.iloc[:, 1], color='blue', alpha=0.1)

plt.title('SARIMAX Forecast of Apple Stock Prices using SP500 as exogenous data')

plt.xlabel('Date')

plt.ylabel('Price')

plt.legend()

plt.show()

# Evaluate the model

from sklearn.metrics import mean_squared_error, mean_absolute_error

mse = mean_squared_error(test['AAPL'], forecasts)

mae = mean_absolute_error(test['AAPL'], forecasts)

rmse = np.sqrt(mse)

print(f'Mean Squared Error: {mse:.4f}')

print(f'Mean Absolute Error: {mae:.4f}')

print(f'Root Mean Squared Error: {rmse:.4f}')

Mean Squared Error: 72.5481

Mean Absolute Error: 5.9930

Root Mean Squared Error: 8.5175

Interpreting the Results

When interpreting the SARIMAX model results, pay attention to:

The coefficient and p-value of the exogenous variable (S&P 500 in this case). A low p-value indicates that the S&P 500 is a significant predictor of Apple’s stock price.

The AIC (Akaike Information Criterion) of the SARIMAX model compared to the SARIMA model without exogenous variables. A lower AIC suggests a better model fit.

The forecast accuracy metrics (MSE, MAE, RMSE) compared to the model without exogenous variables.

As expected from the “update” method, the MAE is much lower (6 against 28 of the previous one). In particular a 1-year forecast is a too far prediction for the model. Hence updating the model (retraining) each month can lead to much better results.

Advantages of Including Exogenous Variables

Improved Accuracy: Exogenous variables can capture external influences on the stock price, potentially leading to more accurate predictions.

Better Understanding of Relationships: The model provides insights into how external factors affect the stock price.

Flexibility: You can include multiple exogenous variables to capture different aspects of the market or economy.

Limitations and Considerations

Data Availability: Ensuring that you have future values of exogenous variables for forecasting can be challenging.

Overfitting Risk: Including too many exogenous variables can lead to overfitting.

Assumption of Linear Relationships: SARIMAX assumes linear relationships between the exogenous variables and the target variable.

Stationarity: Exogenous variables should ideally be stationary or differenced to achieve stationarity.

Conclusion

Incorporating exogenous variables through a SARIMAX model can significantly enhance our ability to forecast Apple stock prices. By including relevant external factors like the S&P 500 index, we can capture broader market trends that influence individual stock performance.

However, it’s crucial to carefully select exogenous variables based on domain knowledge and to rigorously test their impact on model performance. Always validate your model using out-of-sample data and consider combining statistical forecasts with fundamental analysis for a comprehensive investment strategy.