Time Series Analysis and SARIMA Model for Stock Price Prediction

Introduction

The Seasonal Autoregressive Integrated Moving Average (SARIMA) model is an extension of the ARIMA model (discussed in the previous article) that incorporates seasonality. This makes it particularly useful for analyzing financial time series data, which often exhibits both trend and seasonal patterns. In this article, we’ll apply the SARIMA model to Apple (AAPL) stock data, perform signal decomposition, and provide a detailed mathematical explanation of the model.

1. Data Preparation and Exploration

First, let’s obtain the Apple stock data and prepare it for analysis:

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import yfinance as yf

from statsmodels.tsa.seasonal import seasonal_decompose

from statsmodels.tsa.statespace.sarimax import SARIMAX

from statsmodels.tsa.stattools import adfuller, acf, pacf

from pmdarima import auto_arima

import seaborn as sns

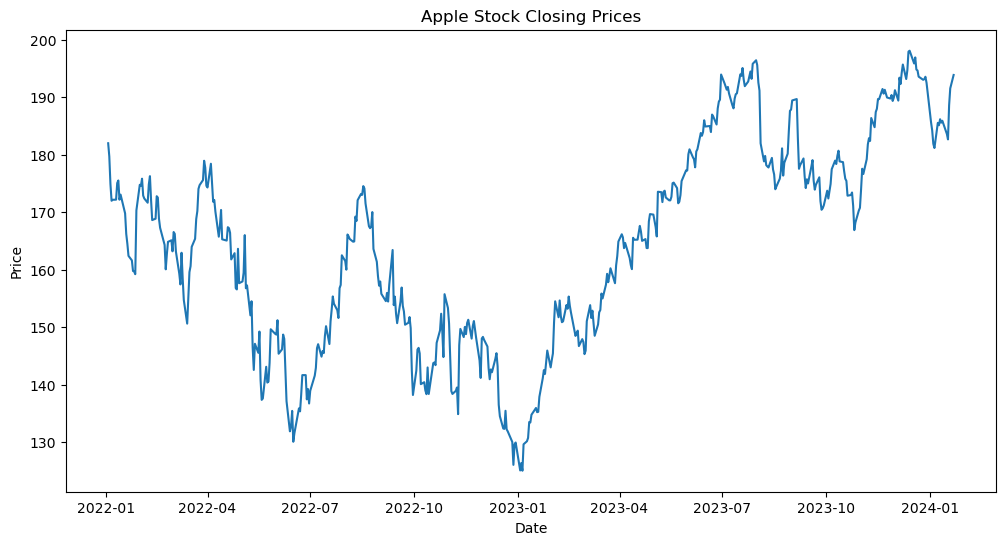

# Download Apple stock data

ticker = "AAPL"

start_date = "2022-01-01"

end_date = "2024-01-23"

data = yf.download(ticker, start=start_date, end=end_date)

df = data.copy()

# Use closing prices for our analysis

ts = data['Close'].dropna()

# Plot the time series

plt.figure(figsize=(12,6))

plt.plot(ts)

plt.title('Apple Stock Closing Prices')

plt.xlabel('Date')

plt.ylabel('Price')

plt.show()

[*********************100%%**********************] 1 of 1 completed

2. Signal Decomposition

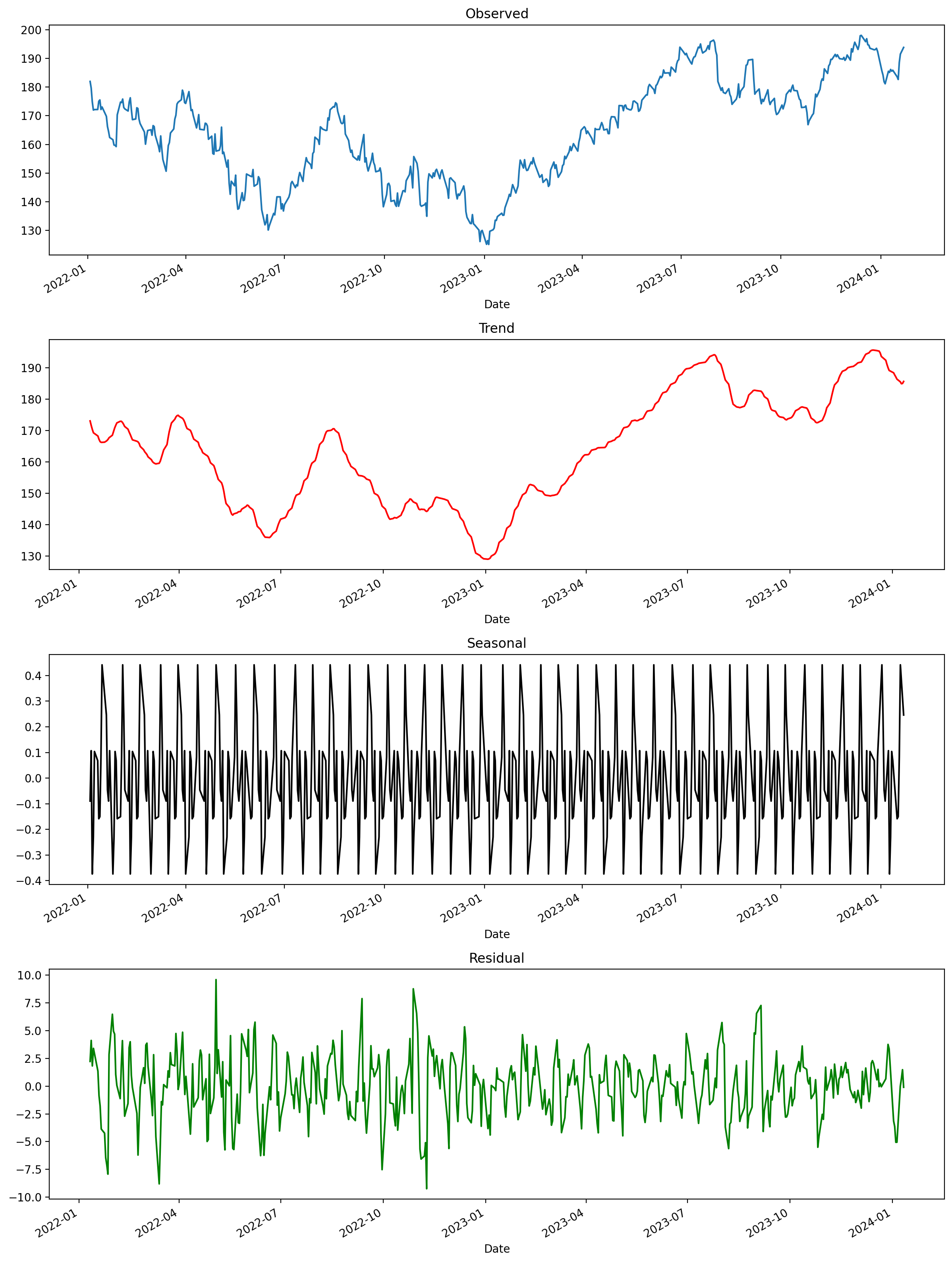

Before we build our SARIMA model, it’s crucial to understand the components of our time series. We’ll use seasonal decomposition to break down the series into trend, seasonal, and residual components:

# Perform seasonal decomposition

decomposition = seasonal_decompose(ts, model='additive', period=12) # 252 trading days in a year

plt.rcParams.update({'figure.dpi':200})

# Plot the decomposition

fig, (ax1, ax2, ax3, ax4) = plt.subplots(4, 1, figsize=(12, 16))

decomposition.observed.plot(ax=ax1)

ax1.set_title('Observed')

decomposition.trend.plot(ax=ax2, c='r')

ax2.set_title('Trend')

decomposition.seasonal.plot(ax=ax3, c='k')

ax3.set_title('Seasonal')

decomposition.resid.plot(ax=ax4, c='g')

ax4.set_title('Residual')

plt.tight_layout()

plt.show()

This decomposition helps us understand:

- Trend: The long-term progression of the series

- Seasonality: Repeating patterns or cycles

- Residual: The noise left after accounting for trend and seasonality

3. Mathematical Formulation of SARIMA

The SARIMA model is denoted as SARIMA(p,d,q)(P,D,Q)m, where:

- p, d, q: Non-seasonal orders of AR, differencing, and MA

- P, D, Q: Seasonal orders of AR, differencing, and MA

- m: Number of periods per season

The mathematical formulation of SARIMA combines the non-seasonal and seasonal components:

Non-seasonal components:

- $AR(p): φ(B) = 1 - φ₁B - φ₂B² - … - φₚBᵖ$

- $MA(q): θ(B) = 1 + θ₁B + θ₂B² + … + θ_qBq$

Seasonal components:

- $SAR(P): Φ(Bᵐ) = 1 - Φ₁Bᵐ - Φ₂B²ᵐ - … - Φ_PBᴾᵐ$

- $SMA(Q): Θ(Bᵐ) = 1 + Θ₁Bᵐ + Θ₂B²ᵐ + … + Θ_QBQᵐ$

Differencing:

- Non-seasonal: $(1-B)ᵈ$

- Seasonal: $(1-Bᵐ)D$

The complete SARIMA model can be written as:

$$φ(B)Φ(Bᵐ)(1-B)ᵈ(1-Bᵐ)D Yₜ = θ(B)Θ(Bᵐ)εₜ$$

Where:

- B is the backshift operator ($BYₜ = Yₜ₋₁$)

- Yₜ is the time series

- εₜ is white noise

4. SARIMA Model Implementation

Now that we understand the components and mathematical formulation, let’s implement the SARIMA model: From the previous article we found that the best (p,d,q)

from pmdarima.arima.utils import nsdiffs

D = nsdiffs(ts,

m=12, # commonly requires knowledge of dataset

max_D=12,

) # -> 0

D

0

# Create Training and Test

train = ts[:int(len(df)*0.8)]

test = ts[int(len(df)*0.8):]

def grid_search_sarima(train, test, p_range, d_range, q_range, P_range, D_range, Q_range, m_range):

best_aic = float('inf')

best_mape = float('inf')

best_order = None

for p in p_range:

for d in d_range:

for q in q_range:

for P in P_range:

for D in D_range:

for Q in Q_range:

for m in m_range:

try:

model = SARIMAX(train.values, order=(p,d,q), seasonal_order=(P,D,Q,m))

results = model.fit()

fc_series = pd.Series(results.forecast(steps=len(test)), index=test.index) # 95% conf

test_metrics = forecast_accuracy(fc_series.values, test.values)

# if results.aic < best_aic:

# best_aic = results.aic

# best_order = (p,d,q)

# print(f"(p,d,q)=({p},{d},{q}) | (P,D,Q,m)=({P},{D},{Q},{m})", test_metrics['mape'])

if test_metrics['mape'] < best_mape:

best_mape = test_metrics['mape']

best_order = (p,d,q)

best_sorder = (P,D,Q,m)

print("temp best:" + f"(p,d,q)=({p},{d},{q}) | (P,D,Q,m)=({P},{D},{Q},{m})",

round(test_metrics['mape'], 4))

except Exception as e:

print(e)

continue

return best_order, best_sorder

# Accuracy metrics

def forecast_accuracy(forecast, actual):

mape = np.mean(np.abs(forecast - actual)/np.abs(actual)) # MAPE

me = np.mean(forecast - actual) # ME

mae = np.mean(np.abs(forecast - actual)) # MAE

mpe = np.mean((forecast - actual)/actual) # MPE

rmse = np.mean((forecast - actual)**2)**.5 # RMSE

corr = np.corrcoef(forecast, actual)[0,1] # corr

mins = np.amin(np.hstack([forecast[:,None],

actual[:,None]]), axis=1)

maxs = np.amax(np.hstack([forecast[:,None],

actual[:,None]]), axis=1)

minmax = 1 - np.mean(mins/maxs) # minmax

acf1 = acf(forecast-test)[1] # ACF1

return({'mape':mape, 'me':me, 'mae': mae,

'mpe': mpe, 'rmse':rmse, 'acf1':acf1,

'corr':corr, 'minmax':minmax})

# Determine optimal SARIMA parameters

# model = auto_arima(ts, seasonal=True, m=12,

# start_p=0, start_q=0, start_P=1, start_Q=1,

# max_p=4, max_q=4, max_P=2, max_Q=2, d=1, D=1,

# trace=True, error_action='ignore', suppress_warnings=True, stepwise=True, out_of_sample=len(test))

# print(model.summary())

# Custom Grid Search

# d = 1 # from

# best_order, best_sorder = grid_search_sarima(train, test, range(0,3), [d], range(0,3), range(3), [D], range(3), [4, 8, 12])

# print(f"Best ARIMA order based on grid search: {best_order}")

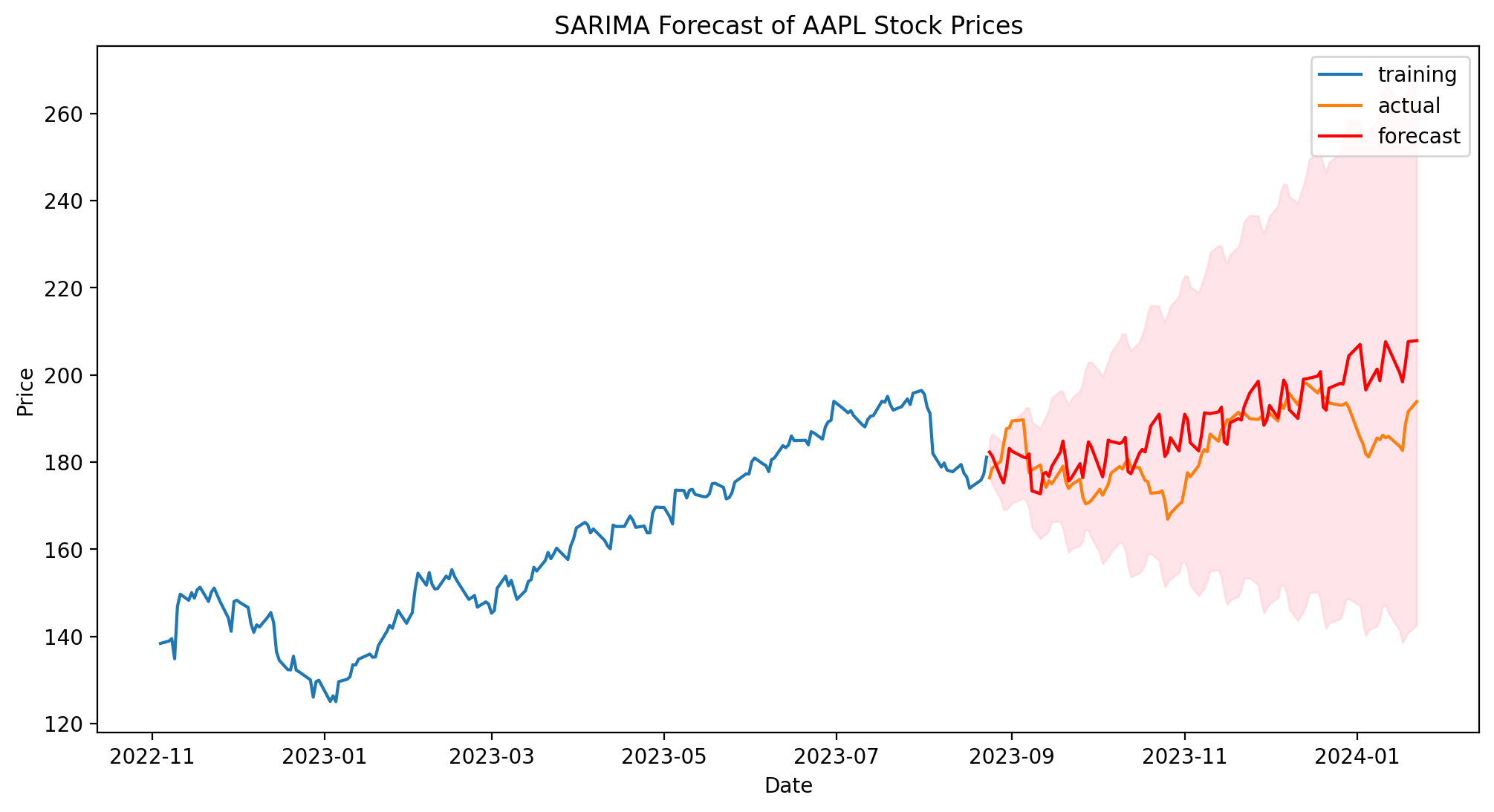

# Fit the SARIMA model

# sarima_model = SARIMAX(ts, order=model.order, seasonal_order=model.seasonal_order) (2,1,2) | (P,D,Q,m)=(2,1,1,

# sarima_model = SARIMAX(train, order=best_order, seasonal_order=best_sorder) #(2,1,2) | (P,D,Q,m)=(2,1,1,8)

# print(best_order, best_sorder)

# sarima_model = SARIMAX(train, order=(2,1,2), seasonal_order=(6,0,6,8))

sarima_model = SARIMAX(train, order=(2,1,2), seasonal_order=(2,2,1,8))

results = sarima_model.fit()

print(results.summary())

SARIMAX Results

===========================================================================================

Dep. Variable: Close No. Observations: 412

Model: SARIMAX(2, 1, 2)x(2, 2, [1], 8) Log Likelihood -1073.473

Date: Fri, 05 Jul 2024 AIC 2162.947

Time: 20:16:14 BIC 2194.778

Sample: 0 HQIC 2175.558

- 412

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 0.0464 0.051 0.902 0.367 -0.054 0.147

ar.L2 0.8356 0.048 17.504 0.000 0.742 0.929

ma.L1 -0.0003 290.396 -1.14e-06 1.000 -569.165 569.164

ma.L2 -0.9997 290.178 -0.003 0.997 -569.739 567.739

ar.S.L8 -0.6368 0.047 -13.574 0.000 -0.729 -0.545

ar.S.L16 -0.2957 0.042 -7.043 0.000 -0.378 -0.213

ma.S.L8 -1.0000 3741.746 -0.000 1.000 -7334.687 7332.687

sigma2 11.5312 4.29e+04 0.000 1.000 -8.4e+04 8.4e+04

===================================================================================

Ljung-Box (L1) (Q): 0.14 Jarque-Bera (JB): 23.66

Prob(Q): 0.71 Prob(JB): 0.00

Heteroskedasticity (H): 0.40 Skew: -0.04

Prob(H) (two-sided): 0.00 Kurtosis: 4.20

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

# sarima_model = SARIMAX(train, order=(2,1,2), seasonal_order=(2,2,1,8))

# results = sarima_model.fit()

# Forecast

forecast_steps = len(test) # Forecast for one year

forecast = results.get_forecast(steps=forecast_steps)

forecast_ci = forecast.conf_int(alpha=0.25)

# forecast_index = pd.date_range(start=test.index[0]+pd.Timedelta(24, 'hours'), periods=len(forecast_ci))

forecast_index = test.index

# Plot the forecast

plt.figure(figsize=(12, 6))

plt.plot(train[-200:], label='training')

# plt.plot(ts.index, ts, label='Observed')

plt.plot(test, label='actual')

plt.plot(forecast_index, forecast.predicted_mean + decomposition.seasonal[test.index].values*10, color='r', label='forecast')

plt.fill_between(forecast_index, forecast_ci.iloc[:, 0], forecast_ci.iloc[:, 1], color='pink', alpha=0.4)

plt.title(f'SARIMA Forecast of {ticker} Stock Prices')

plt.xlabel('Date')

plt.ylabel('Price')

plt.legend()

plt.show()

As the previous plot shows, SARIMA model takes into account stagionality with respect to the ARIMA model and provides better accuracy and mape score (5% vs. 7%). Moreover, the stagionality can deal with temporary detachment from the mean value. Nonetheless, SARIMA model is slower to train and to interfer (respectively $\approx 100\% $ and $50\%$ more). It still does not involve exogenous variables (possible with SARIMAX) and potential outbreaks (like Covid-19 or holidays).

5. Model Diagnostics

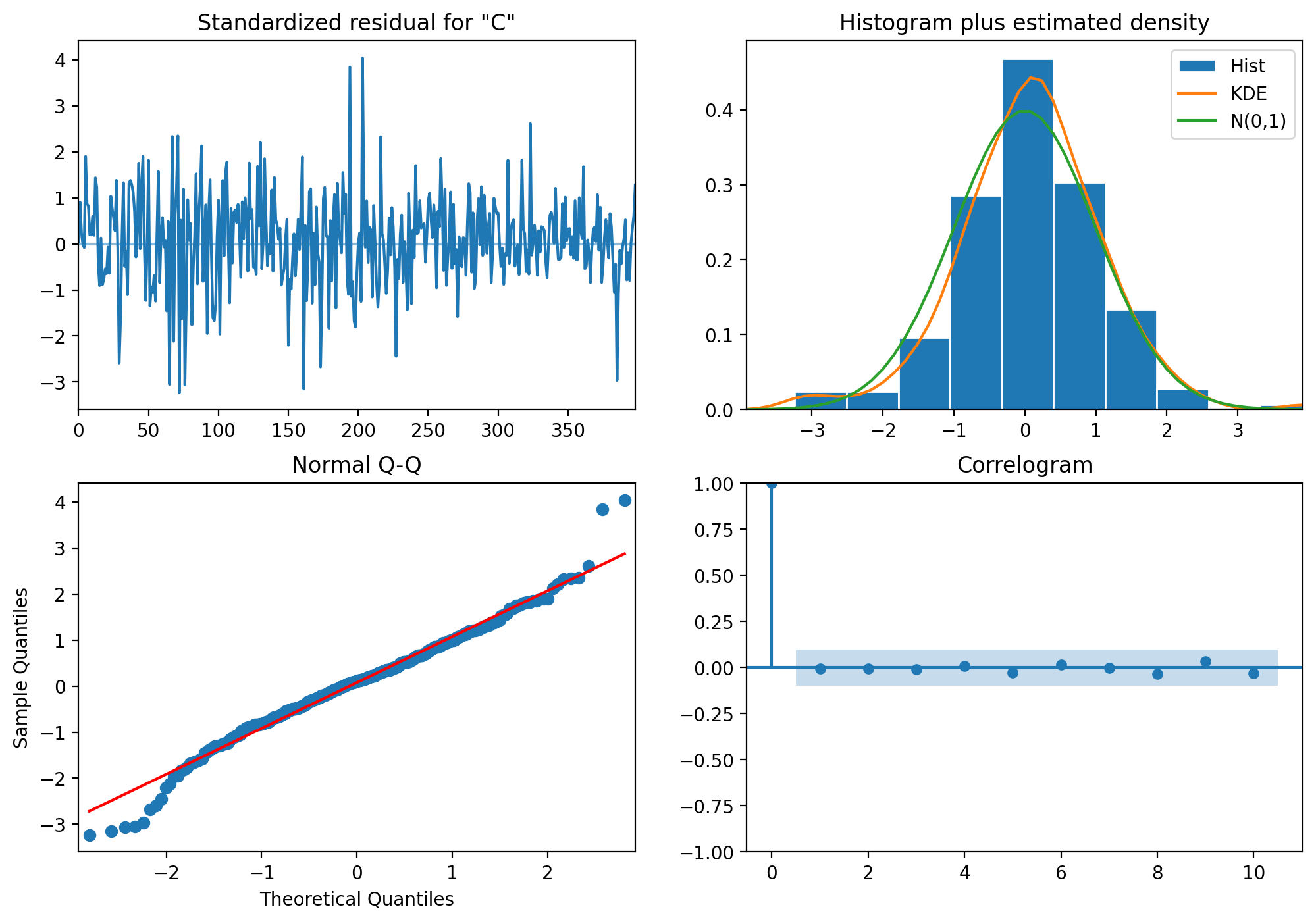

After fitting the model, it’s important to check its adequacy:

# Model diagnostics

results.plot_diagnostics(figsize=(12, 8))

plt.show()

These diagnostic plots help us check for:

- Standardized residual: Should resemble white noise

- Histogram plus KDE: Should be normally distributed

- Q-Q plot: Should follow the straight line

- Correlogram: Should show no significant autocorrelation

Conclusion

The SARIMA model provides a powerful tool for analyzing and forecasting time series data with both trend and seasonal components. By decomposing the Apple stock price series and applying a SARIMA model, we’ve gained insights into the underlying patterns and potential future movements of the stock.

Key takeaways:

- Signal decomposition revealed clear trend and seasonal components in Apple’s stock price.

- The SARIMA model captures both non-seasonal and seasonal patterns in the data.

- Model diagnostics are crucial for ensuring the validity of our forecasts.

Remember that while these models can provide valuable insights, stock prices are influenced by many external factors not captured in historical data alone. Always combine statistical analysis with fundamental research and an understanding of market conditions when making investment decisions.